Erectile dysfunction (ED) can significantly impact retirement planning by affecting emotional well-being, financial stability, and social interactions. It is essential to address healthcare needs, maintain open communication with partners, and adopt a healthy lifestyle. By implementing strategies such as exploring new activities and building strong social networks, individuals can enhance their quality of life and enjoy a fulfilling retirement despite the challenges posed by ED.

How does erectile dysfunction affect retirement plans? For many, it can change how they envision their golden years. This condition not only impacts intimate relationships but also has broader implications for financial stability and emotional well-being. As couples age, understanding this issue becomes crucial in creating a fulfilling retirement. In this article, we will explore the multifaceted effects of erectile dysfunction on retirement planning, covering financial impacts, emotional considerations, and strategies to navigate this challenge.

Understanding Erectile Dysfunction

Erectile dysfunction (ED) is a common condition that affects many men as they age. It refers to the inability to achieve or maintain an erection suitable for sexual intercourse. While often seen as a private issue, ED can have wide-ranging impacts, particularly as men reach retirement age.

Causes of Erectile Dysfunction

ED may result from various factors, including physical and psychological conditions. Physical causes often include diabetes, heart disease, and obesity. Psychological issues such as stress, anxiety, and depression can also play significant roles. Lifestyle choices, like smoking and excessive alcohol consumption, may contribute to ED as well.

Symptoms and Diagnosis

Men experiencing ED may notice difficulty in achieving an erection, reduced sexual desire, or issues with ejaculation. A thorough diagnosis from a healthcare provider typically includes a medical history review and physical examination. In some cases, additional tests may be necessary to identify underlying conditions.

Treatment Options

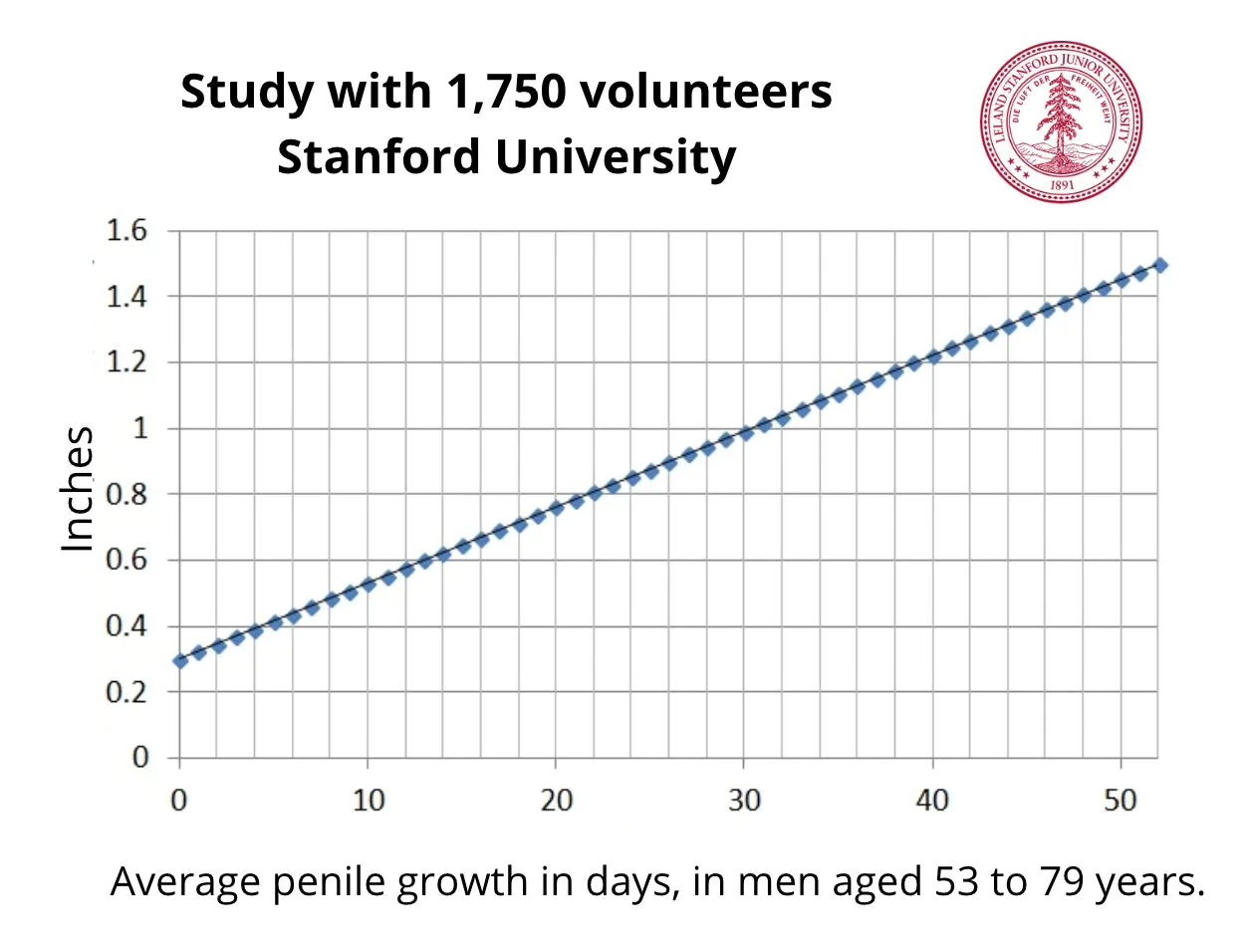

Fortunately, several treatment options are available for ED. These can range from lifestyle changes, like exercise and diet improvements, to medications specifically designed to enhance blood flow. In some instances, therapy may be recommended to address psychological factors contributing to ED.

As men approach retirement, understanding ED is crucial for maintaining their overall quality of life. Addressing the condition proactively can lead to better physical health and stronger relationships, which are essential in enjoying these later years.

Financial Implications for Retirement

Financial implications of erectile dysfunction (ED) can be significant, especially as individuals transition into retirement. One of the primary concerns is the long-term cost of treatment options available for ED.

Medical Expenses

Men may need to budget for regular doctor visits, medications, and possible therapies. These treatments can add up quickly, potentially straining retirement savings. Insurance coverage for ED treatments varies, meaning some may need to cover these expenses out-of-pocket.

Impact on Relationships

ED can also affect relationships, which can lead to increased stress. This stress may result in couples seeking counseling or therapy, leading to further financial costs. Improving relationship dynamics might not only be important emotionally but can also help reduce additional expenses related to misunderstandings and conflicts.

Changes in Lifestyle

Men experiencing ED may feel prompted to change their lifestyle. This might include joining gyms or purchasing healthier food options. While these changes can enhance health, they also represent new costs that must be factored into a budget.

Insurance Coverage and Planning

When planning finances for retirement, individuals should evaluate their health coverage carefully. This includes understanding what their insurance will cover concerning ED treatments. Knowing these details can help in making informed financial decisions for retirement.

Considering all these factors, understanding the financial implications of erectile dysfunction is paramount for effective retirement planning. A proactive approach to managing both health and finances can greatly enhance the quality of life during retirement.

Emotional and Social Aspects

Erectile dysfunction (ED) carries significant emotional and social aspects that can affect individuals and their relationships, especially during retirement. Understanding these feelings is vital for navigating this challenging time.

Emotional Impact

For many men, ED can lead to feelings of inadequacy and loss of self-esteem. It’s common for individuals to feel frustrated, anxious, or even depressed because they cannot perform sexually. These feelings can become even more pronounced in retirement when the focus shifts to personal fulfillment and intimacy.

Impact on Relationships

The emotional strain caused by ED often extends to romantic partners. Couples may experience tension, leading to communication breakdowns and misunderstandings. Without open dialogue, partners might feel isolated or neglected, stressing the relationship.

Social Stigma

There is often a stigma surrounding ED, making it hard for individuals to discuss their condition. Many may worry about how others perceive them. This silence can lead to social withdrawal and isolation, preventing men from seeking the support they need.

Importance of Communication

To address these emotional and social challenges, it is crucial for couples to communicate effectively. Discussing feelings, fears, and potential solutions can foster deeper connections and understanding. Couples can explore alternative ways to express affection, strengthening their bond.

Seeking professional help, whether through therapy or support groups, can also be beneficial. These resources may provide emotional support and help couples navigate the challenges related to ED together, reinforcing the importance of intimacy in their relationship.

Planning for Healthcare Needs

Planning for healthcare needs is crucial for individuals experiencing erectile dysfunction (ED), especially as they approach retirement. Managing both physical and emotional health effectively can improve overall quality of life.

Assessing Health Coverage

Before retirement, it’s important to review health insurance plans. Understanding what services and treatments related to ED are covered can help avoid unexpected expenses. This knowledge allows individuals to plan financially for their healthcare needs.

Regular Medical Check-ups

Frequent visits to healthcare providers for diagnosis and treatment are vital. Regular check-ups can not only help manage ED but also identify other health issues early. This proactive approach contributes to better health outcomes over time.

Integration of Specialists

Consulting with specialists, such as urologists or sex therapists, can provide targeted treatment options. These professionals often have specific insights into the challenges associated with ED and can tailor a care plan that aligns with personal health goals.

Accessing Support Services

In addition to medical professionals, access to support groups can be beneficial. Engaging with others facing similar challenges can provide valuable emotional support. Many organizations offer resources that help individuals connect with others going through similar experiences.

Planning for Future Healthcare Costs

Considering the potential costs related to ongoing healthcare needs is also essential. Setting aside funds in a healthcare savings account specifically for ED treatments can help manage future expenses efficiently, ensuring that individuals do not neglect their health as they age.

Strategies for a Fulfilling Retirement

Creating strategies for a fulfilling retirement is essential for individuals dealing with erectile dysfunction (ED). A proactive approach helps maintain not only physical health but also emotional well-being.

Open Communication with Partners

Discussing feelings and concerns about ED with partners can strengthen relationships. Open dialogues foster understanding and intimacy, ensuring both partners feel supported. This connection is vital for enjoying a fulfilling retirement together.

Explore New Activities

Retirement presents an opportunity to explore new hobbies and interests. Engaging in activities like travel, volunteering, or pursuing creative passions can increase happiness. Staying active helps distract from concerns related to ED and enhances overall quality of life.

Focus on Health and Wellness

Maintaining a healthy lifestyle should be a priority. Regular exercise, balanced nutrition, and sufficient sleep can improve both physical and mental health. This focus on wellness can positively influence sexual health and alleviate some concerns associated with ED.

Seek Professional Help

When challenges arise, seeking help from professionals can be beneficial. Therapists can provide strategies to cope with feelings related to ED and help individuals work through emotional struggles. This support is crucial for a fulfilling retirement experience.

Build Strong Social Networks

Having a robust social circle can enhance the retirement experience. Participating in social activities can mitigate feelings of isolation, especially when dealing with sensitivity around ED. Connecting with peers offers support, validation, and various perspectives on managing similar challenges.

Understanding the Impact of Erectile Dysfunction on Retirement Planning

Erectile dysfunction (ED) is more than a personal health issue; it influences various aspects of retirement planning. By recognizing its effects on emotional, financial, and social dimensions, individuals can better prepare for a fulfilling retirement. Establishing open communication with partners, seeking professional help, and focusing on health and wellness are essential strategies that can mitigate the challenges posed by ED.

Moreover, integrating social connections and exploring new interests can enhance the quality of life during retirement. By proactively addressing these aspects, individuals can navigate the complexities of ED and foster a rewarding and enjoyable retirement experience.

Ultimately, understanding and managing erectile dysfunction can lead to a healthier mindset, improved relationships, and a more fulfilling life in retirement.

FAQ – Frequently Asked Questions About Erectile Dysfunction and Retirement Planning

How does erectile dysfunction affect retirement planning?

Erectile dysfunction can impact emotional well-being, relationships, and financial planning, making it essential to address these issues during retirement.

What emotional challenges are associated with erectile dysfunction?

Individuals may experience decreased self-esteem, anxiety, or depression due to ED, which can strain relationships and affect overall quality of life.

What healthcare needs should I consider regarding erectile dysfunction?

It’s important to assess health insurance coverage for ED treatments, schedule regular medical check-ups, and seek specialized care when needed.

What strategies can help in managing erectile dysfunction during retirement?

Open communication with partners, engaging in new activities, maintaining a healthy lifestyle, and building strong social networks can help manage ED effectively.

Are there support resources available for couples dealing with erectile dysfunction?

Yes, many organizations offer support groups and resources that help couples navigate the emotional and social challenges associated with ED.

What lifestyle changes can improve erectile dysfunction?

Regular exercise, a balanced diet, stress management, and avoiding smoking and excessive alcohol can enhance sexual health and reduce ED symptoms.